One of the first wind power stations in Russia sits on the Commander Islands — a group of scrubby, sparsely inhabited mountainous rocks 100 miles off the country’s eastern coast in the Bering Sea.

Started with a donation of two turbines from Denmark in the 1990s, the mini wind farm was designed to halve the 700 islanders’ reliance on diesel to generate their electricity. Given frequent storms and irregular travel connections, the dirty fuel can cost twice as much as on the mainland.

When Georgy Safanov, director of the Center for Environment and Natural Resource Economics at Moscow’s Higher School of Economics recently visited the islands he noticed that only one of the four wind turbines was in operation. The next day, the situation was the same — with a different turbine spinning but the other three switched off.

“I asked the locals, ‘Why aren’t you using them? They are here, that’s free energy for you,’” Safanov told The Moscow Times.

The answer, he said, gives a blunt insight into Russia’s approach to renewable energy.

“They replied, ‘We could use them all, but we still have a diesel power generator. And that’s owned by guys who are close to our village administration.’”

“Russia has huge, huge potential for renewables, everywhere and in everything — solar, wind, hydro, geothermal, biofuels. But the economics around the energy system are very traditional and corrupt,” Safanov said, adding that he believes these problems are stunting Russia’s renewables industry.

Unrealized potential

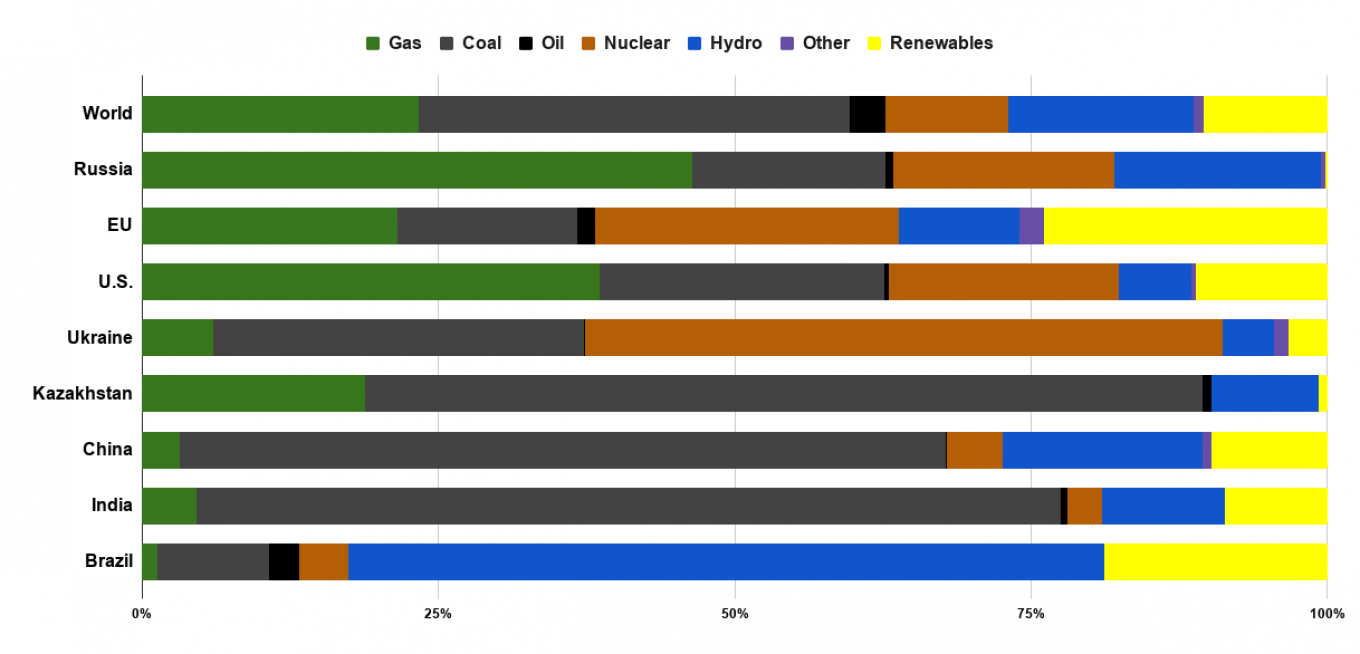

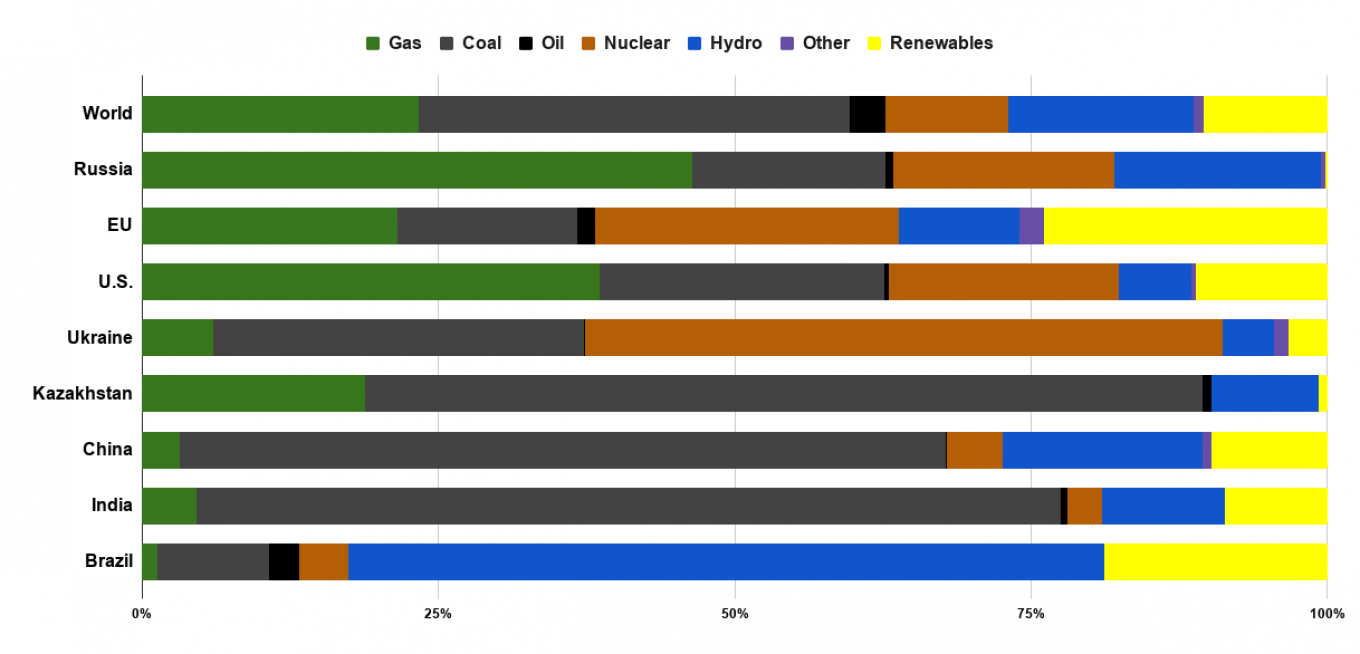

Only 0.16% of Russia’s electricity was generated from renewable sources in 2019, according to the BP statistical review of world energy. The world average is more than 10%, and in Europe it is around 20%. While Russia stands fourth in the world for overall electricity generation, it is ranked 109th for renewables.

Analysts and industry figures say the situation in Russia is unlikely to change as it comes out of the coronavirus pandemic, despite some of the world’s largest economies allocating substantial extra cash to fight climate change and accelerate decarbonization.

“In Europe, crisis response plans have renewable energy and climate projects in first place. In ours … we don’t see any ambitious plans to restart the Russian economy using carbon-free technologies or by investing into carbon-free projects,” said Alexey Zhikharev, director of the Association for the Development of Renewable Energy (RREDA).

Despite a Kremlin target to generate 4.5% of Russia’s electricity from renewable sources by 2024, Zhikharev says even if every project currently in development comes online in time, the best case scenario will be 1%.

“Medium-term plans for [renewables] capacity are at a very low level — even compared to our neighbors like Ukraine, Uzbekistan or Kazakhstan, without considering China or the U.S.,” Zhikharev added, pointing out that China commissions 100 times more capacity per year in new renewable energy projects than Russia.

The Kremlin’s latest energy strategy, in force from June and running until 2035, makes little mention of renewables or a transition to clean energy, said Maria Shagina, a researcher who focuses on Russia’s energy sector. It even pencils in higher investment in coal projects — seen by many as the dirtiest kind of fossil fuel. When Russia talks of energy diversification or an energy transition, it usually means balancing export markets for vital multi-billion dollar oil and gas exports, she added.

“The strategy is definitely one, if not two steps behind what’s happening. And the pandemic has compounded that and made it even worse,” Shagina said.

Completely unprepared

Russia is “completely unprepared,” for a world moving away from hydrocarbons and becoming more and more committed to tackling climate change, said Tatiana Mitrova, director of the Skolkovo Energy Center.

“The Russian government is… very sceptical concerning the anthropogenic nature of climate change,” she told The Moscow Times. This leads to a passive, box-ticking approach to green initiatives — such as Russia’s belated ratification of the Paris Climate Accords, when the Kremlin eventually signed up, but chose a baseline emissions level so high that it requires practically no effort to ensure compliance.

Mitrova is among those pushing the Russian government to incentivize renewables and make the economy more green.

“We should use this period when the state will be launching stimulus packages to push economic growth, to use at least some part of it for green technologies.”

But a detailed package of green proposals put to the Russian government over the last few months wasn’t met with enthusiasm. Analysts say the state’s capacity for supporting the energy industry is dominated by big ticket or geopolitical projects like the OPEC+ agreement, tax breaks for Arctic oil or LNG projects and flagship pipelines like Nord Stream 2 to Europe and the Power of Siberia to China.

“Goals like decarbonization or increasing the share of renewables are not a priority,” says RREDA’s Zhikharev. “There is no ‘unified position’ within the government regarding whether or not to support the renewables industry.” Some see it as a potential growth industry and source of highly skilled well-paid jobs, while others argue renewables will increase energy costs for consumers, he said.

The powerful fossil fuel lobby is also holding back Russia’s potential renewables development, others say.

“There are still very few incentives for change. There are interest groups happy with the status quo … and there are a lot of Russian decision makers who still don’t believe the prospects for green energy” said Igor Makarov, head of the world economy program at the Higher School of Economics.

“The preference is given to orthodox energy monopolies — big markets should be assigned to big friends,” Safanov explained.

“Even in regions where there is lots of green energy potential, like Kamchatka, what you see is that Gazprom built a gas pipeline there, so everybody should use gas. There are no plans for big green projects or huge tidal power plants which could be built there.”

Those hoping the coronavirus pandemic, a fall in energy use and volatility in oil and gas markets could trigger a rethink are likely to be disappointed.

“Inside Russia, the coronavirus crisis is considered a temporary, short-term issue. It’s a few months, not a long-term thing. So why should we change our model now? Climate change — the bigger, longer-term crisis — is not considered at all,” said Safanov.

External pressure

While a Europe-style green new deal may be firmly off the table, Russia could still come under pressure from decarbonization efforts in its largest trading partner.

The continued development of low-carbon energy sources in Europe, as well as the potential for carbon border taxes could significantly hit Russian energy exports — with analysts agreeing that any catalyst for a green change in Russia is likely to come from outside economic pressure, rather than domestic considerations or a desire to confront climate change.

Some big Russian corporations with exposure to western markets have woken up to the rising importance of Environment, Social and Governance (ESG) concerns.

“Russian exporters are demonstrating more and more interest in the renewable energy sector,” says Zhikharev. “They are looking for opportunities to conclude direct purchasing agreements with renewable energy generators. Within the next three to five years this will be a very active trend, as businesses start to understand that the competitiveness of their products on the global market could be lost.”

Aluminium maker Rusal has rolled out various emissions-reductions programs and low-carbon products, while privately-owned oil major Lukoil has committed to becoming a net zero carbon emitter by 2050.

However, as green energy advocates have found, this pressure has not reached a critical point yet.

“It’s sufficient to start a discussion about green issues, climate change and renewable energy, but not to make some dramatic changes in Russia’s state policy,” said Makarov. Moreover, Russia is not as exposed to western trends like ESG, since the state or state-controlled banks are the main sources of investment, not foreign investors.

Looking to the future of Russia’s renewables industry, Safanov concluded: “I don’t see any internal drivers for substantial change. It’s a long story with tiny steps. If we continue with our current approach to renewables, we’ll get to something like 40-50% of our energy mix. But by the end of the century.”